UAE Crypto Regulations 2026: Why Dubai Is the World’s Crypto Capital in 2026

Blockzia

Need help navigating your Web3 challenges?

Most Web3 companies don't fail because of bad ideas. They fail because of flawed tokenomics, wrong regulatory structures, and go-to-market strategies borrowed from Web2 playbooks. Blockzia exists to solve all three — with UAE-specific expertise that turns your blockchain vision into a compliant, fundable, market-ready venture.

Key Takeaways

The UAE Web3 ecosystem in 2026 is the product of deliberate strategy, institutional investment, and regulatory architecture built specifically for digital assets. The key elements:

- ✅ Government blockchain commitment embedded in national strategic frameworks (UAE 2031, Blockchain Strategy)

- ✅ Multi-pathway regulatory environment (VARA, ADGM, DFSA) serving all stages and business models

- ✅ Zero personal income tax, zero capital gains tax, and VAT exemptions on virtual asset trading

- ✅ Active institutional ecosystem with licensed global exchanges, venture capital, and banking infrastructure

- ✅ World-class events (TOKEN2049, GITEX) creating deal flow and community

- ✅ First-mover government blockchain adoption (DLD real estate tokenization, Smart Dubai)

- ✅ Clean FATF record enabling international institutional participation

For founders choosing where to build their Web3 company, the UAE is not just a viable option — in 2026, it is the leading one.

Something significant happened in the global Web3 industry over the last three years. The center of gravity shifted. Not to a single city, but to a country — the United Arab Emirates — and it happened faster than most of the industry expected.

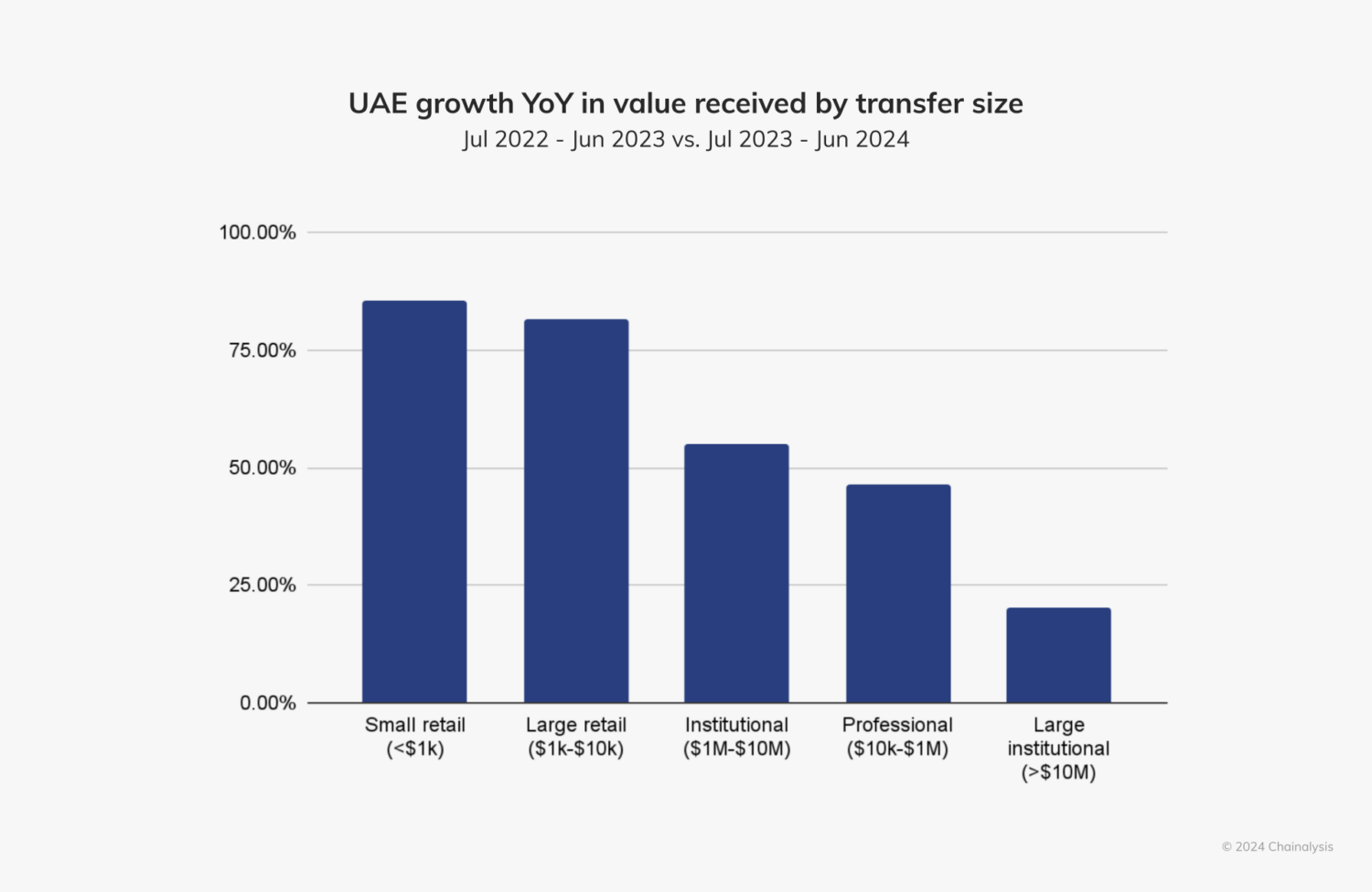

With more than $30 billion in crypto inflows over the last 12 months, retail transaction growth exceeding 80%, and 1 in 4 adults holding digital assets, the UAE’s rise is anchored in measurable activity — not hype.

This is not a story about a tax haven attracting crypto. It is a story about a government that decided to make Web3 central to its next phase of economic development and built the infrastructure to prove it.

The Strategic Vision Behind the UAE Web3 Ecosystem

The UAE’s commitment to Web3 is embedded in its national strategic frameworks — frameworks that predate the current bull market and will outlast it.

The UAE Blockchain Strategy 2021, launched in April 2018, positioned the country among the first to treat distributed ledger technology as a pillar of public sector innovation. The objective was to migrate half of all government transactions onto blockchain by 2021.

The ‘We the UAE 2031’ vision, launched in November 2022, integrates blockchain and digital assets as pivotal tools for the next phase of economic diversification. The UAE is not treating crypto as a speculative asset — it is treating it as infrastructure.

The Emirates Blockchain Strategy aimed to migrate half of government transactions onto blockchain, and has since expanded to include healthcare, logistics, and land registration under Smart Dubai and Dubai Future Foundation programs.

This government-level commitment is what differentiates the UAE from crypto hubs that rely purely on favorable regulation. The UAE is building the use cases, not just the rules.

The Regulatory Foundation: Why It Matters for Builders

The UAE Web3 ecosystem’s strength rests on a regulatory foundation that no other jurisdiction has matched for combination of depth, speed, and clarity.

The UAE’s approach involves multiple authorities across federal and emirate levels: VARA for Dubai, ADGM’s FSRA for Abu Dhabi, DFSA for DIFC, and the SCA at the federal level. This multi-jurisdictional approach allows fintech companies to choose the framework that best matches their business model.

The result: both institutional asset managers and fintech startups can flourish in parallel — using regulatory frameworks designed specifically for their use case.

The FATF Clean Record

A critical milestone for the UAE’s institutional credibility was its removal from the FATF grey list in February 2024 and from the European Parliament grey list in July 2025. This clean bill of health means UAE-licensed entities operate with full international regulatory recognition — enabling banking relationships, institutional capital flows, and cross-border partnerships that grey-listed jurisdictions cannot access.

The UAE Web3 Ecosystem: Key Players and Infrastructure

Exchanges and Trading Infrastructure

Major global exchanges have chosen the UAE as their regulated operational base:

- ✅ Binance secured a UAE crypto license from VARA in 2024, enabling full retail and institutional services

- ✅ Kraken holds a license for UAE market access

- ✅ Bit Oasis (regional leader) and Palmex operate as locally-grown licensed exchanges

- ✅ OKX, Bybit, and others maintain UAE operations under regulatory oversight

This concentration of licensed, regulated exchanges creates the liquidity infrastructure necessary for a functional market — not just a regulatory label.

Institutional Capital and Venture Ecosystem

The UAE’s venture and institutional ecosystem is world-class:

- ✅ Hub71 in Abu Dhabi — a government-backed tech hub that includes Hub71+ Digital Assets, specifically focused on blockchain and Web3 companies

- ✅ Dubai Future Accelerators — connecting Web3 builders with government entities

- ✅ Emirates NBD, Mashreq Bank, and digital banks like Zand building crypto-native banking infrastructure

- ✅ Global VCs with UAE presence including Andreessen Horowitz (a16z), Sequoia, Binance Labs, and regional funds with dedicated Web3 mandates

Animoca Brands exemplifies the institutional-to-startup bridge: after receiving its full VARA license in February 2026, it has positioned itself as a conduit between international Web3 builders and institutional finance in the Gulf, with investments including a $7 million round for UAE-based Param Labs and a $50 million commitment linked to NEOM.

Web3 Real Estate: The Dubai Land Department Pilot

One of the most significant signals of government commitment to Web3 is the Dubai Land Department’s Real Estate Tokenization Pilot — launched in 2025 with the objective of tokenizing 7% of the national property market.

The DLD platform uses XRP Ledger as its technical backbone, with Zand Digital Bank as banking partner and regulatory oversight from VARA, the UAE Central Bank, and the Dubai Future Foundation. The platform integrates directly with DLD’s systems to ensure blockchain records stay in sync with traditional government real estate ledgers.

This is not a proof of concept. It is a government department actively moving its core asset registry onto blockchain infrastructure.

Free Zones Powering the Ecosystem

Several specialized free zones have emerged as foundational infrastructure for the UAE Web3 ecosystem:

DMCC Crypto Centre — Among the first free zones globally to offer dedicated crypto licensing infrastructure. Hosts hundreds of blockchain-adjacent companies.

Hub71+ Digital Assets (Abu Dhabi) — Government-backed accelerator offering workspace, co-investment, and market access for Web3 companies.

RAK Digital Assets Oasis (RAK DAO) — Purpose-built for decentralized applications, DAOs, and NFT projects. Provides legal wrappers for DAO structures.

Dubai Multi Commodities Centre (DMCC) — Home to commodity tokenization and blockchain-linked trading infrastructure.

Tax Advantages: The Financial Case

The financial case for the UAE Web3 ecosystem is straightforward:

- ✅ Zero personal income tax on salaries, investment returns, and crypto profits

- ✅ Zero capital gains tax on crypto asset appreciation

- ✅ VAT exemptions on the trading and conversion of virtual assets

- ✅ Corporate tax of 9% (with significant exemptions for qualifying activities including fund management and capital activities)

Until December 31, 2026, a taxable person whose income does not exceed the threshold of AED 3,000,000 (approximately €758,000) is not subject to corporate tax at all.

No equivalent jurisdiction — Singapore, Switzerland, Gibraltar, Malta — offers this combination of tax minimalism, regulatory clarity, and ecosystem depth simultaneously.

Major Web3 Events: Where the Industry Meets

The UAE hosts the events that define global blockchain industry direction:

TOKEN 2049 Dubai — One of the two global TOKEN 2049 flagship events (alongside Singapore). Attracts thousands of founders, investors, and ecosystem builders annually.

GITEX Global — World’s largest tech show, with dedicated AI and blockchain tracks. A critical networking event for UAE and MENA market access.

Dubai FinTech Summit — Institutional-focused event bringing together traditional finance and Web3.

Abu Dhabi Finance Week (ADFW) — High-level institutional event with significant digital assets programming.

These events create deal flow, partnerships, and community that money alone cannot buy.

UAE Web3 Ecosystem vs. Competing Hubs

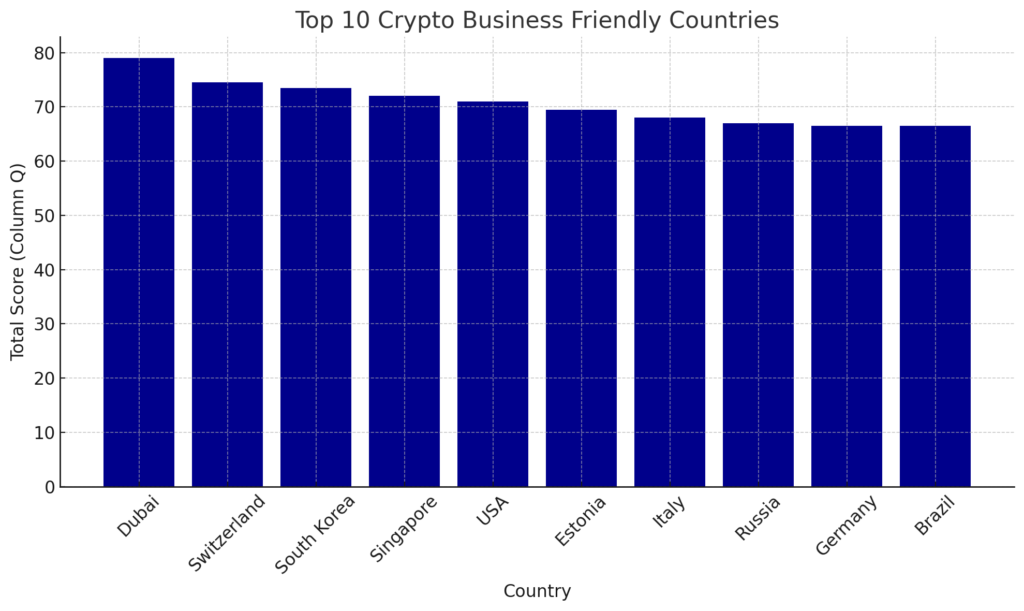

What the UAE has that no single competitor offers is the combination: zero personal tax, deep regulatory clarity across multiple pathways, active government blockchain adoption, institutional infrastructure, and genuine community scale.

What’s Coming: UAE Web3 in 2026 and Beyond

CARF Implementation (2027) — International crypto tax reporting framework begins. UAE-based operators will participate in global information sharing — a sign of mainstream regulatory integration, not a retreat from crypto.

Real Estate Tokenization Expansion — Dubai’s 7% property market tokenization target is an early milestone. The DLD platform plans to expand access globally from initial UAE ID-holder access. Analysts project tokenized real estate markets reaching $1.4 trillion by 2026 globally, with UAE leading.

DeFi Integration — VARA’s formal regulation of tokenized RWAs under the Asset-Referenced Virtual Assets (ARVA) classification opens pathways for compliant DeFi in Dubai. Real estate tokens will increasingly integrate with lending protocols, automated market makers, and compliant liquidity infrastructure.

Stablecoin Regulation — ADGM’s Fiat Referenced Token framework update (effective January 2026) and CBUAE’s payment token framework create the infrastructure for regulated AED stablecoins and broader digital payments.

AI and Web3 Convergence — The UAE’s parallel investment in AI infrastructure (through the UAE AI Office and Abu Dhabi’s AI ecosystem) positions it uniquely for the convergence of AI-powered blockchain applications.

A: For the combination of regulatory clarity, tax advantages, institutional infrastructure, and government commitment to Web3, the UAE — particularly Dubai and Abu Dhabi — offers the strongest overall environment globally. Singapore and Hong Kong compete in specific areas, but neither matches the UAE's complete package in 2026.

A: The most direct pathways are obtaining a VARA license (for VASP activities), registering in a UAE free zone (DMCC, RAK DAO, or Hub71 for non-VASP activities), or applying to Hub71+ Digital Assets for the Abu Dhabi startup ecosystem. Each provides legal entity setup, visa access, and ecosystem integration.

A: Hub71+ Digital Assets provides co-investment, workspace, and market access. The Dubai Future Foundation runs accelerators and innovation challenges. VARA's Sponsored VASP regime allows earlier-stage companies to operate under licensed sponsors. ADGM's RegLab provides a sandbox for testing with reduced capital requirements.