Web3 Consulting Services: The Complete Guide to Scaling Your Blockchain Startup in 2026

Blockzia

Need help navigating your Web3 challenges?

Whether you need a tokenomics stress test, go-to-market strategy, or technical architecture validation, specialized consulting can help you move faster and avoid expensive mistakes. The question isn't whether you need outside expertise—it's whether you bring it in before or after costly missteps.

Ideal Reader Journey

- Founder googles “web3 consulting services“

- Reads comprehensive guide establishing your expertise

- Self-identifies their stage (pre-fundraise, post-raise, growth, crisis)

- Recognizes specific gap (tokenomics, tech stack, GTM)

- Clicks through to diagnostic offer or books consultation

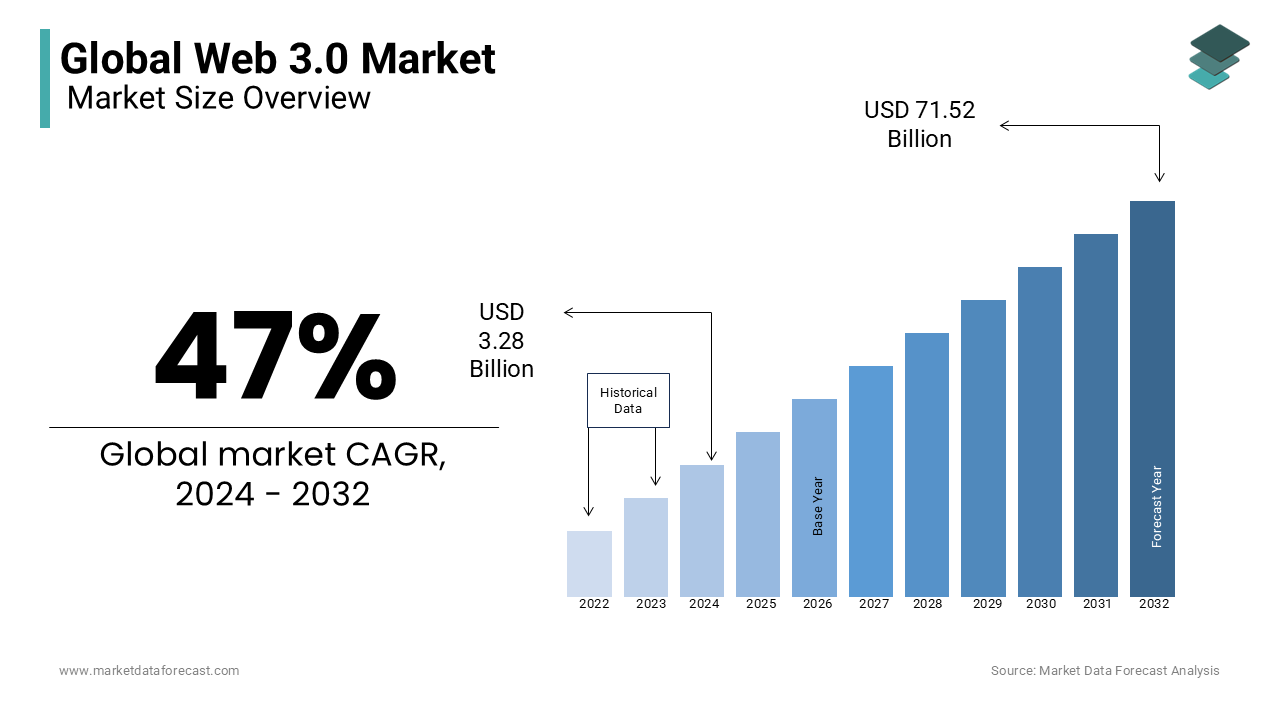

The Web3 landscape has evolved dramatically. What worked for blockchain startups in 2021 won’t cut it in 2026. If you’re a founder navigating tokenomics, go-to-market strategy, or technical architecture decisions, you’re likely facing questions that traditional business consultants simply can’t answer.

This is where specialized web3 consulting services become not just helpful, but essential.

What Are Web3 Consulting Services?

Web3 consulting services provide strategic guidance and tactical execution support for blockchain startups and decentralized projects. Unlike traditional consulting, web3 advisors bring deep expertise in areas unique to decentralized technology: tokenomics design, smart contract architecture, DAO governance, crypto-native GTM strategies, and regulatory navigation.

The best web3 consulting services bridge three critical gaps:

Strategic clarity – Helping founders define their value proposition in a crowded, skeptical market Technical validation – Ensuring your tech stack can actually deliver on your promises Execution support – Moving from strategy decks to shipped products and real traction

Why Web3 Startups Need Specialized Consulting

The Stakes Are Higher in Web3

Traditional startup advice doesn’t translate to blockchain. A SaaS consultant won’t understand token velocity. A fintech advisor won’t grasp liquidity pool dynamics. A growth marketer won’t know how to navigate Discord communities and governance proposals.

Web3 founders face unique challenges:

- Tokenomics complexity: Your economic model is your product, and getting it wrong can destroy value overnight

- Regulatory uncertainty: The compliance landscape shifts monthly, and mistakes are expensive

- Community expectations: Your users are often investors, governance participants, and vocal critics simultaneously

- Technical debt at scale: Smart contract bugs can’t be hotfixed like traditional software

- Go-to-market uniqueness: Traditional channels like Google Ads and LinkedIn often prohibit crypto products

When to Bring in Web3 Consulting Services

Most founders wait too long. Here are the inflection points where consulting delivers maximum ROI:

Pre-fundraise – Before you pitch VCs, validate that your tokenomics actually work and your tech stack can scale Post-raise, pre-launch – You have capital but need to move fast without breaking things Growth plateau – You shipped but can’t crack product-market fit or sustainable user acquisition Crisis mode – Token price collapsing, community revolt, or technical vulnerabilities discovered

Core Web3 Consulting Service Areas

1. Tokenomics Consulting

This is where most blockchain projects live or die. Tokenomics consulting services help you:

- Design token utility that creates genuine demand (not just speculation)

- Model emission schedules that balance growth with sustainability

- Structure vesting and allocation to align incentives

- Stress-test your economic model against market volatility and user behavior

A proper tokenomics stress test can reveal fatal flaws before you lock them into immutable smart contracts. It’s the difference between a token that sustains value and one that enters a death spiral six months post-launch.

2. Go-to-Market Strategy for Web3

Web3 go-to-market strategy requires completely different playbooks than Web2. Blockchain consulting for startups in this area covers:

- Community-first growth models (before product-led or sales-led)

- Crypto-native distribution channels (beyond the platforms that ban you)

- Partnership strategies that leverage network effects

- Launch sequencing that builds sustainable momentum

The best crypto startup consulting firms understand that your GTM strategy must account for regulatory constraints, exchange listings, market maker relationships, and community governance expectations simultaneously.

3. Technical Architecture & Stack Audits

A web3 tech stack audit examines whether your technical decisions will scale, remain secure, and deliver on your product promises. This includes:

- Smart contract architecture review

- Layer 1/Layer 2 selection validation

- Scalability stress testing

- Security vulnerability assessment

- Infrastructure cost modeling at scale

Many projects choose their tech stack based on what’s trendy rather than what’s appropriate. A thorough web3 readiness assessment can save millions in future migration costs.

4. Blockchain Implementation Support

Moving from whitepaper to working product requires a blockchain implementation partner who understands both the vision and the execution. Implementation consulting addresses:

- Development roadmap prioritization

- Technical team building and gaps assessment

- Vendor selection for critical infrastructure

- DevOps and deployment strategies

- Testing protocols for smart contract deployment

The gap between strategy and execution kills more Web3 projects than bad ideas do.

How to Choose the Right Web3 Consulting Services

Not all blockchain consultants are created equal. Here’s what to look for:

Deep Specialization Over Generalization

Avoid consultants who claim expertise across all of Web3. The best tokenomics consulting firms focus narrowly on economic modeling. The best technical auditors focus on smart contract security. The best GTM consultants focus on crypto-native growth.

Look for evidence of deep work in your specific area: DeFi protocols, NFT projects, infrastructure, gaming, or DAO tooling.

Track Record with Similar-Stage Companies

A consultant who helped a DeFi protocol go from $10M to $500M TVL may not be the right fit for your pre-seed project trying to validate product-market fit. Match the consultant’s experience to your current stage and challenges.

Diagnostic Before Prescription

The best web3 consulting services start with assessment, not solutions. Be skeptical of consultants who propose detailed strategies before deeply understanding your specific situation. A proper tokenomics audit or web3 readiness assessment should come first.

Execution Capability, Not Just Strategy Decks

Beautiful slide decks don’t ship products. Look for blockchain implementation partners who can roll up their sleeves, write code, build financial models, draft governance proposals, or manage community launches—whatever your actual bottleneck is.

Transparent Pricing and Scope

Web3 consulting services pricing varies wildly. Expect:

- Quick diagnostics: $5K – $15K for focused audits or assessments

- Strategic consulting: $15K – $50K for go-to-market strategy or tokenomics design

- Implementation support: $30K – $150K+ for hands-on execution over 3-6 months

Be wary of consultants who can’t clearly scope the work or who push for equity when cash compensation is market-standard.

Common Web3 Consulting Mistakes to Avoid

Mistake 1: Treating It Like Traditional Consulting

McKinsey playbooks don’t work in Web3. If your consultant is talking about TAM/SAM/SOM analysis and market research reports, they’re bringing the wrong framework.

Mistake 2: Hiring for Credentials Over Results

A former Big 4 consultant or Goldman analyst doesn’t automatically understand decentralized systems. Look for people who’ve built, launched, and scaled Web3 projects, not people with impressive Web2 résumés.

Mistake 3: Waiting Until Crisis Mode

The time to bring in tokenomics consulting is before you finalize your economic model, not after your token has lost 80% of its value. The time for a web3 tech stack audit is before you build your smart contracts, not after you discover critical vulnerabilities.

Mistake 4: Expecting Consultants to Do Everything

Consultants should fill specific gaps in your expertise or capacity. They shouldn’t replace your founding team’s strategic thinking or your team’s execution responsibility. The best engagements are collaborative, not outsourced.

The Future of Web3 Consulting Services

As the blockchain industry matures, consulting is specializing further. We’re seeing the emergence of:

- Tokenomics quants who build sophisticated economic simulations

- Crypto compliance specialists who navigate global regulatory frameworks

- Web3 growth experts who crack sustainable user acquisition

- DAO governance consultants who design effective decentralized decision-making

The generalist “blockchain advisor” is being replaced by deep specialists who can solve specific, high-stakes problems.

Getting Started with Web3 Consulting

If you’re considering bringing in consulting support, start here:

- Identify your specific bottleneck – Don’t hire generalists; know exactly what problem you need solved

- Run a diagnostic first – A focused audit or assessment will reveal whether you need strategic help or execution support

- Check references ruthlessly – Talk to founders who’ve worked with the consultant at similar stages

- Start with a defined scope – Prove value with a focused engagement before committing to long-term retainers

- Measure outcomes, not activities – Good consulting should lead to better decisions, shipped features, or measurable traction

The right web3 consulting services can compress years of painful learning into weeks of focused execution. The wrong consultants will drain your budget while providing generic advice you could have found on Twitter.

Choose wisely. Your runway depends on it.

Before making irreversible decisions: finalizing tokenomics, choosing blockchain platforms, fundraising, or mainnet launch. Proactive consulting is 10x cheaper than crisis consulting after problems emerge.

No. Top consultants often prefer cash. Equity (0.25%-2%) makes sense for long-term strategic advisors, but not for project-based work. Be selective about dilution.

Look for shipped blockchain products, verifiable results, technical depth (can they code?), strong references from founders, and public work (research, speaking, protocol contributions). Avoid those with only Web2 credentials.

Pre-seed: validation and feasibility. Seed: tokenomics design, tech stack selection. Post-seed: GTM strategy and scaling. Growth: optimization and expansion. Earlier is better—fixing mistakes later is expensive.

A web3 readiness assessment evaluates product-market fit, technical feasibility, economic sustainability, competitive positioning, GTM viability, and regulatory clarity. Better to discover fatal flaws before building than after.

Focus on tokenomics sustainability, technical credibility, community positioning, and Web3-native advantages. Crypto investors care less about traditional TAM analysis and more about economic design and ecosystem fit.